Extension of JobKeeper

August 2 2020

The Treasury has announced the following: JobKeeper 1.0 will remain till 27 September 2020 and; thereafter, JobKeeper 2.0 will continue for a further six months till 28 March 2021. The changes to JobKeeper are: There will be two rates of JobKeeper payments for eligible businesses (including self-employed) and not-for-profits: 1. From 28 September 2020 to […]

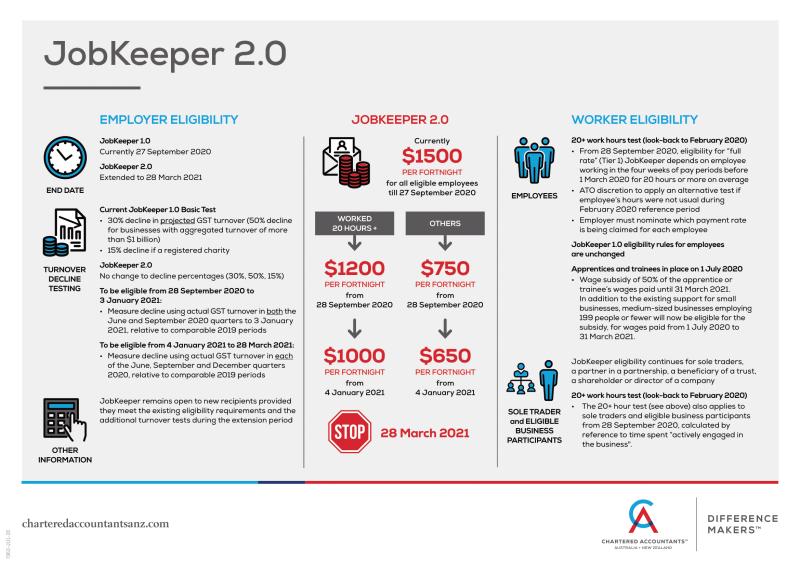

The Treasury has announced the following:

- JobKeeper 1.0 will remain till 27 September 2020 and;

- thereafter, JobKeeper 2.0 will continue for a further six months till 28 March 2021.

The changes to JobKeeper are:

- There will be two rates of JobKeeper payments for eligible businesses (including self-employed) and not-for-profits:

1. From 28 September 2020 to 3 January 2021:

- for eligible employees and business participants who worked 20 hours or more a week on average in the month of February 2020 – A$1200 per fortnight

- for eligible employees and business participants who worked less than 20 hours a week on average in the month of February 2020 – A$750 per fortnight.

2. From 4 January 2021 to 28 March 2021:

- for eligible employees and business participants who worked 20 hours or more a week on average in the month of February 2020 – A$1000 per fortnight

- for eligible employees and business participants who worked less than 20 hours a week on average in the month of February 2020 – A$650 per fortnight.

The JobKeeper payment will be tapered in the December and March quarters to encourage businesses to adjust to the new environment, supporting a gradual transition to economic recovery. The two-tiered payment aims to better align the payment with the incomes of employees before the onset of the COVID-19 pandemic.

- The thresholds for the decline in turnover test will remain the same but now the test must be applied at several points:

- To be eligible for the JobKeeper payments from 28 September 2020 to 3 January 2021, businesses and not-for-profits must satisfy the relevant decline in turnover test for the June quarter and for the September quarter based on actual GST turnover.

- To be eligible for the JobKeeper payments from 4 January 2021 to 28 March 2021, businesses and not-for-profits must satisfy the relevant decline in turnover test for each of the June, September and December quarters based on actual GST turnover.

The requirement to reassess the eligibility for the JobKeeper payments over the extension period is to ensure that only the businesses that need the most help will continue to receive the payments.

The JobKeeper payment will remain open to new recipients provided they meet the existing eligibility requirements and the additional turnover tests during the extension period.

The Commissioner of Taxation will have discretion to set alternative tests where an employee’s or business participant’s hours were not usual during the February 2020 reference period.

Employers will continue to be required to make payments to employees equal to, or greater than, the amount of the JobKeeper payment (before tax), based on the payment rate that applies to each employee (i.e. the wage condition).

The changes are expected to be implemented through amendments to the legislative instrument, Coronavirus Economic Response Package (Payments and Benefits) Rules 2020.

Changes to the JobSeeker program include:

- The JobSeeker coronvirus supplement will decrease to A$250 a fortnight from A$550. Therefore, people on JobSeeker will receive a decrease from A$1100 to A$800 (base rate of A$550 plus the coronavirus supplement) per fortnight after September.

- Recipients will be allowed to earn A$300 a fortnight before facing a reduction in their Government payment.

- Easing of restrictions for sole traders.

In conjunction with the Government’s announced changes, Treasury has released the report, The JobKeeper Payment: Three-month review. The Government considered the findings in the report in formulating its changes to the JobKeeper payment.

If you have any questions, please contact your Accountant for further clarification.